Understanding the Traditional Income Statement: Definition, Examples, and More

If you are new to HBS Online, you will be required to set up an account before enrolling in the program of your choice. Automating data entry processes and conducting regular audits can help reduce manual data entry errors like duplication and omissions. It’s important to do monthly account reconciliations to maintain data integrity and ensure financial records are accurate and follow the rules. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. If you handle money at all (personal life, business, etc.), you need a budget. They immediately feel like they’re back in math class having to turn…

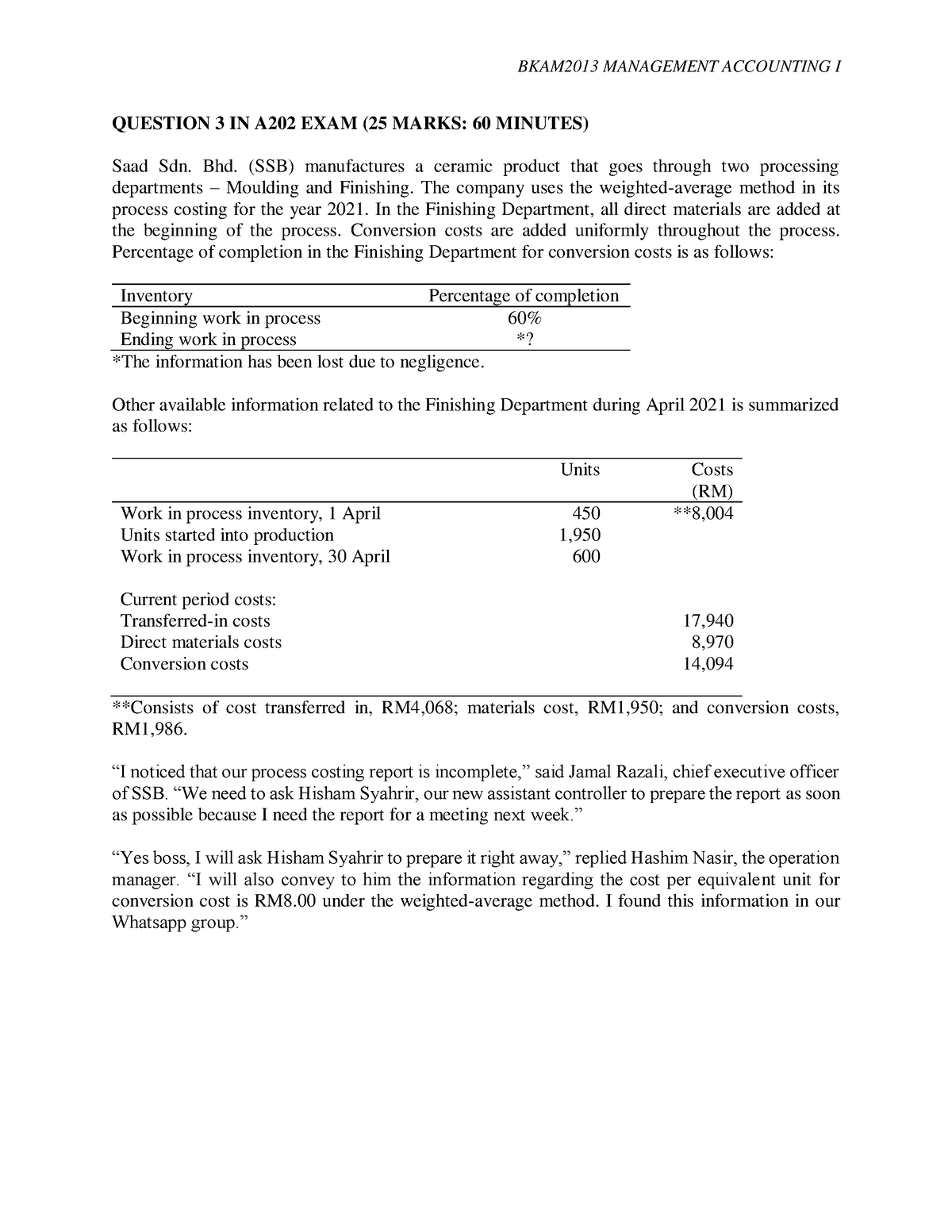

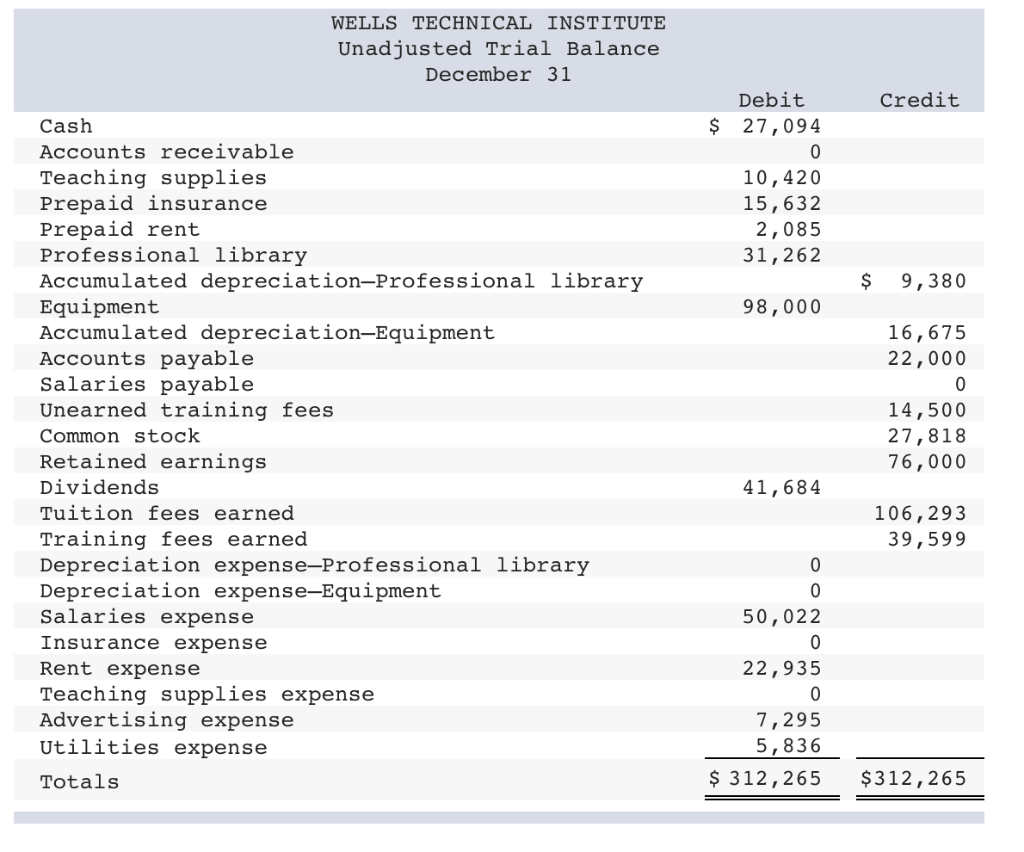

Cost Accounting in Income Statements

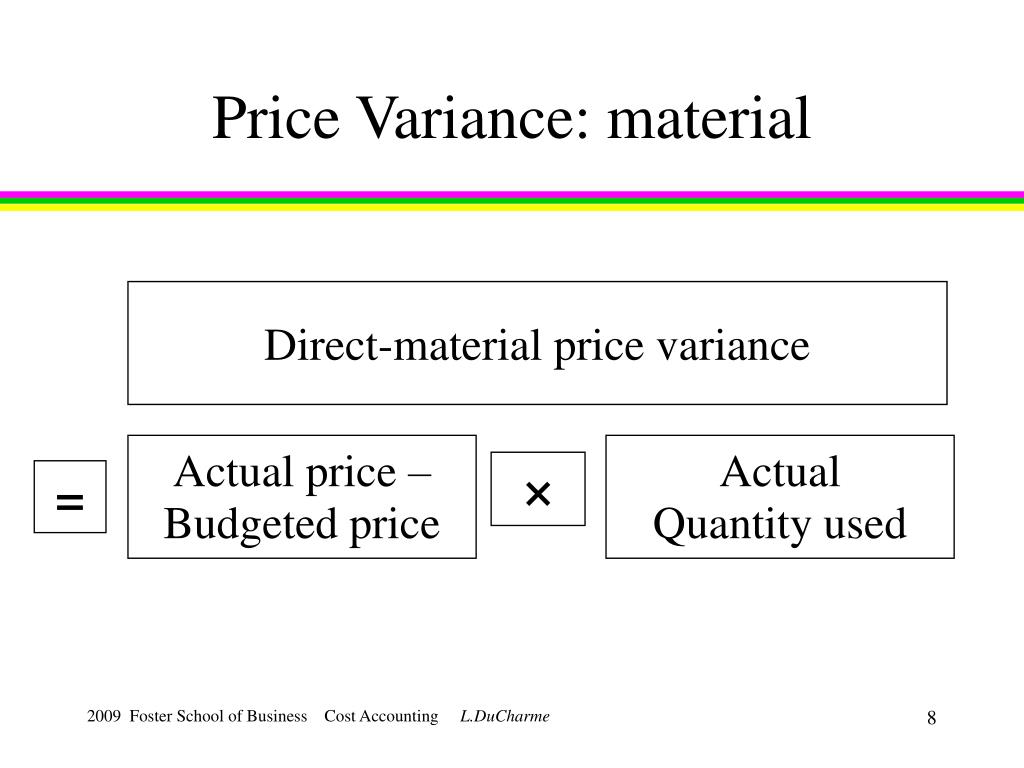

These expenses include both fixed overhead, like rent, and variable overhead, like electricity that changes with use. This number is important because it gives an overview of the company’s operation success before any other how to handle discounts in accounting chron com costs or gains that aren’t part of the main business. In this section, we’re going to explore how cost accounting fits into income statements. First up, we’ll define what cost accounting is and why it’s important.

Revenues

Taxes are incredibly complex, so we may not have been able to answer your question in the article. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have. You can connect with a licensed CPA or EA who can file your business tax returns. Set your business up for success with our free small business tax calculator. Save more by mixing and matching the bookkeeping, tax, and consultation services you need. Dear auto-entrepreneurs, yes, you too have accounting obligations (albeit lighter!).

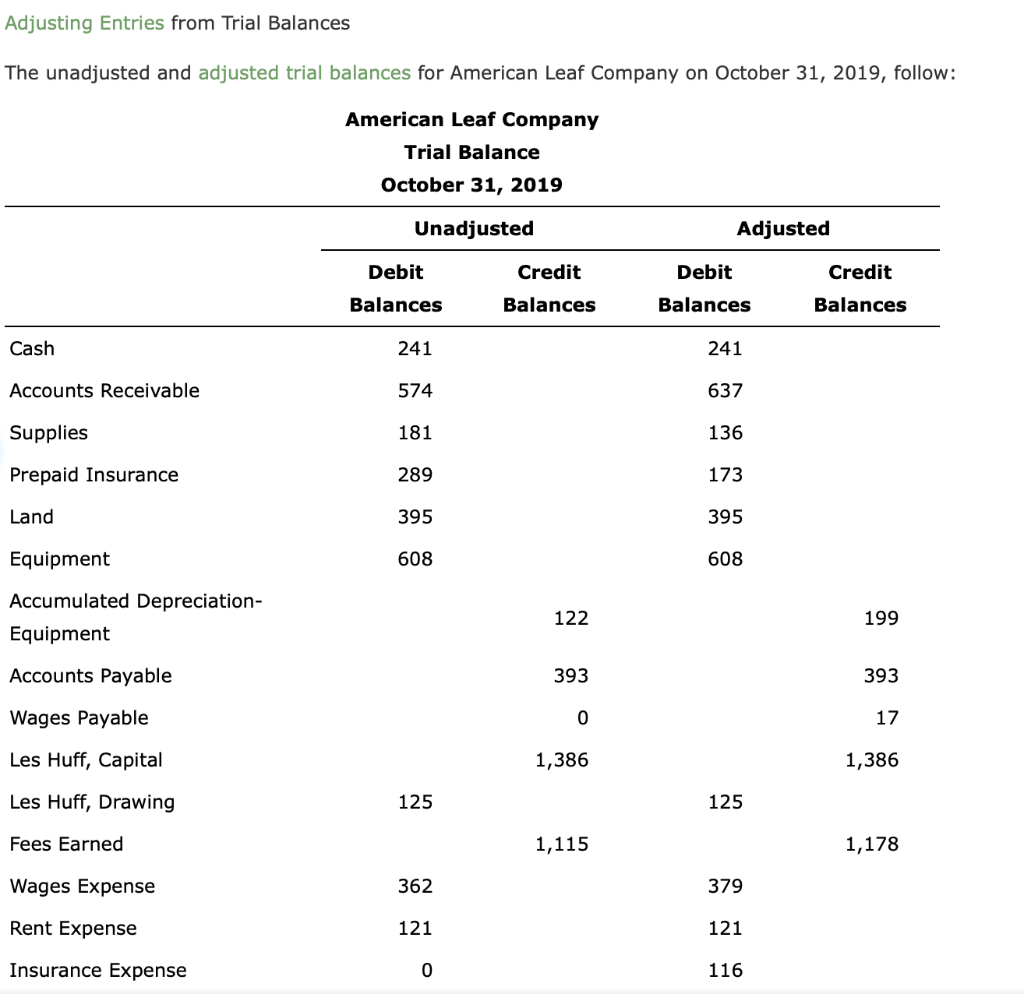

Gross Profit

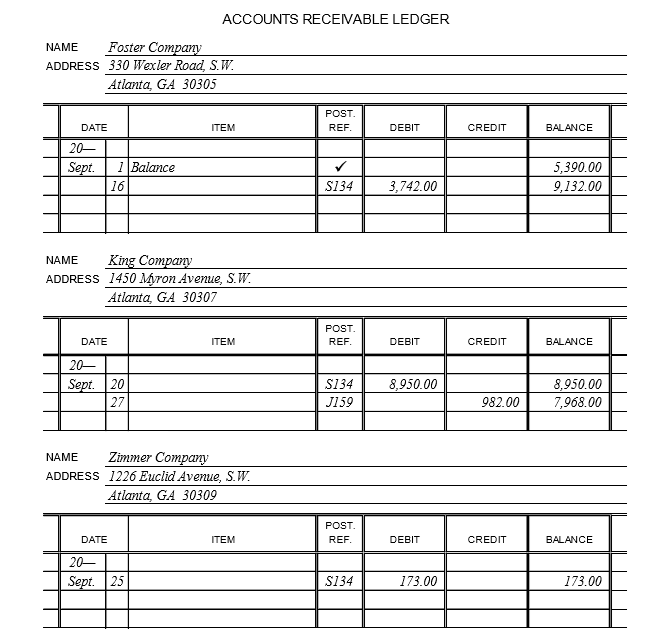

From this amount, the cost of goods sold amounting to $47,000 is deducted in order to arrive at the first level of profitability which is the gross profit. Non-operating items are further classified into non-operating revenue and non-operating expenses. This means that revenues and expenses are classified whether they are part of the primary operations of the business or not.

Traditional Income Statement Guide: Format, Example & Cost Accounting Definition

The format of a traditional income statement is simpler than the multi-step income statement, which categorizes expenses by function and provides multiple levels of income (e.g., gross profit, operating income). Creditors are often more concerned about a company’s future cash flows than its past profitability. However, their research analysts can use an income statement to compare year-on-year and quarter-on-quarter performance. They can infer, for example, whether a company’s efforts at reducing the cost of sales helped it improve profits over time, or whether management kept tabs on operating expenses without compromising on profitability. A traditional income statement is a way to see how a company is doing with its money. First, you see the money coming in from selling things, which is called revenue.

Application of Absorption Costing in Income Statements

- The income statement is also vital for ratio analysis, equity research, and valuation of the company.

- Some of these expenses may be written off on a tax return if they meet Internal Revenue Service (IRS) guidelines.

- The primary purpose of an income statement is to convey details of profitability and business activities of the company to the stakeholders.

- Therefore, you should treat the selling and administrative costs like a mixed cost.

This can also be referred to as earnings before interest and taxes (EBIT). This exclusion poses a significant challenge in accurately assessing the true performance and profitability of an organization. Fixed costs, such as rent and salaries, and variable costs, including materials and utilities, are essential components in determining the total cost structure and operational efficiency. Their absence from the income statement results in a skewed representation of the company’s financial standing, influencing crucial metrics such as gross margin and operating income.

Accounting books, annual accounts, compulsory chartered accountants… Find out how this alternative financing method works, with its many advantages.

With a traditional income statement, a company’s net income is calculated using both production costs and the amount of units sold by the company. A company’s net income line is therefore affected by the amount of accounts it has of specific products during the period covered by a financial report. Investors can scan an income statement for key financial points like revenue and costs/expenses, so they can get a sense of how the company is performing. They can see at a glance, for examples, whether the company’s profitability is driven by increasing sales, decreasing costs or both. The information on a traditional income statement is important to investors.

The learning of these skills in reading financial statements, evaluating a company’s value, and managing financial risks is fundamental knowledge to help you get noticed in the world of finance. A cash flow statement tells us how much cash moves through our business and whether or not we have money for expenses. Next, let’s see the different types of financial statements that make such things possible and what role each type plays in helping us understand, control, and develop our business. The income statement is a tool to help you know if your business is doing well, based on a specific period, like a month or a year.

Therefore, your income statement is a simple matter of revenue minus expenses. Next, we’ll check out an example to see how it all works with real numbers, kind of like watching a demo. Lastly, we’ll learn how to make one ourselves, step by step, just like following a simple recipe. This way, you’ll see how a business figures out if it’s making money or not.