Cash flow statement indirect method

It produces what is called the net cash flow by breaking down where the changes in the beginning and ending balances came from. If we only looked at our net income, we might believe we had $60,000 cash on hand. In that case, we wouldn’t truly know what we had to work with—and we’d run the risk of overspending, budgeting incorrectly, or misrepresenting our liquidity to loan officers or business partners. Under Cash Flow from Investing Activities, we reverse those investments, removing the cash on hand.

- They could conclude that this looks pretty good for the first year of operations and incorrectly assume that the company now has $300,000 available to spend.

- In the field of financial management, there is an old saying that revenue is vanity, profits are sanity, but cash is king.

- As a different possibility, an asset account such as Equipment may have experienced more than one transaction rather than just a single purchase.

- Analysts look in this section to see if there are any changes in capital expenditures (CapEx).

Statements of cash flow using the direct and indirect methods

When you pay off part of your loan or line of credit, money leaves your bank accounts. When you tap your line of credit, get a loan, or bring on a new investor, you receive cash in your accounts. Using the cash flow statement example above, here’s a more detailed look at what each section does, and what it means for your business. Since it’s simpler book value of debt definition than the direct method, many small businesses prefer this approach. Also, when using the indirect method, you do not have to go back and reconcile your statements with the direct method. The direct method takes more legwork and organization than the indirect method—you need to produce and track cash receipts for every cash transaction.

Great! The Financial Professional Will Get Back To You Soon.

Secondarily, decreases in accrued revenue accounts indicates that cash was collected in the current period but was recorded as revenue on a previous period’s income statement. In both scenarios, the net income reported on the income statement was lower than the actual net cash effect of the transactions. To reconcile net income to cash flow from operating activities, add decreases in current assets. Changes in the various current assets and liabilities can be determined from analysis of the company’s comparative balance sheet, which lists the current period and previous period balances for all assets and liabilities. Under the direct method, actual cash flows are presented for items that affect cash flow. Examples of the items that are usually presented under this approach are cash collected from customers, interest and dividends received, cash paid to employees, cash paid to suppliers, interest paid, and income taxes paid.

Statement of Cash Flows Indirect Method

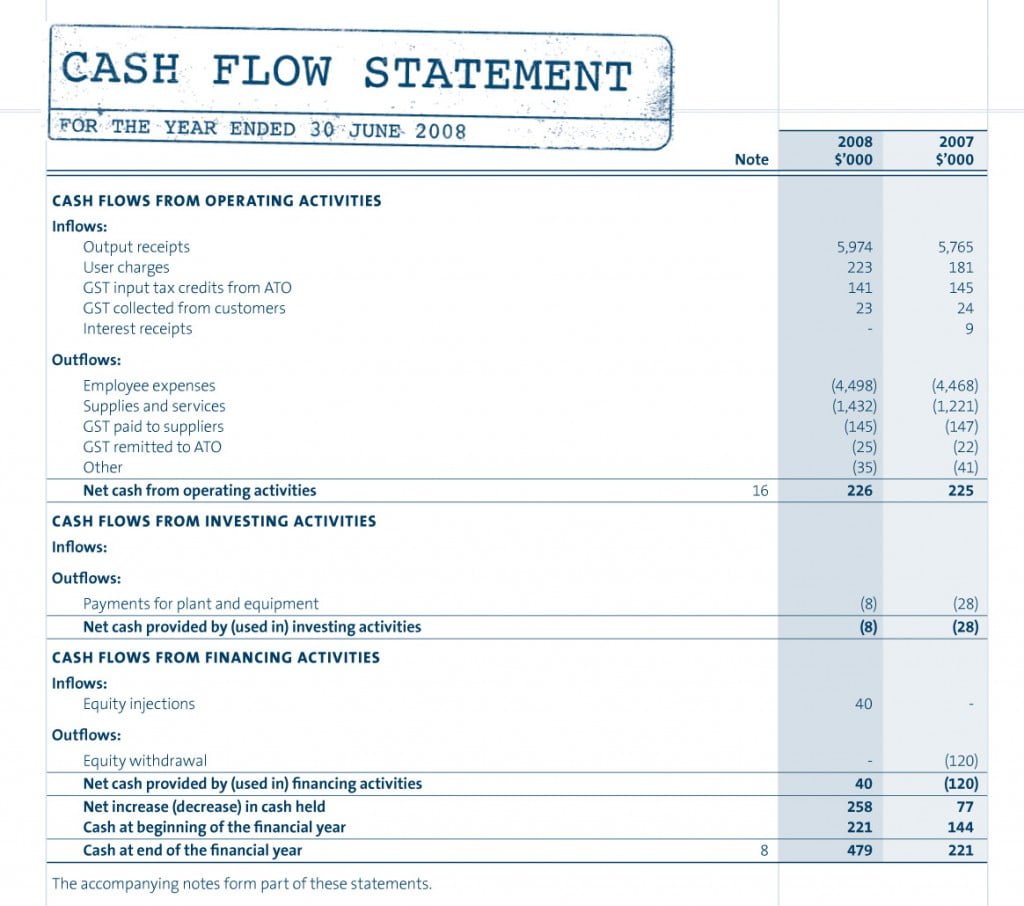

The statement of cash flows is a central component of an entity’s financial statements. Potentially misunderstood and often an afterthought when financial statements are being prepared, it provides key information about an entity’s financial health and its capacity to generate cash. Net cash flow from operating activities is the net income of the company, adjusted to reflect the cash impact of operating activities. Positive net cash flow generally indicates adequate cash flow margins exist to provide continuity or ensure survival of the company. The magnitude of the net cash flow, if large, suggests a comfortable cash flow cushion, while a smaller net cash flow would signify an uneasy comfort cash flow zone. Transactions that do not affect cash but do affect long-term assets, long-term debt, and/or equity are disclosed, either as a notation at the bottom of the statement of cash flow, or in the notes to the financial statements.

Then, we’ll walk through an example cash flow statement, and show you how to create your own using a template. This Handbook provides an in-depth look at statement of cash flows classification issues and noncash disclosure requirements. We’ve organized it by transaction type, making it easier to identify the answers to the common and not so common questions that you may have. And for practical issues where the guidance remains unclear, we offer our views on how to classify many of these cash flows.

Why do you need cash flow statements?

Therefore, it should always be used in unison with the income statement and balance sheet to get a complete financial overview of the company. The cash flow statement does not replace the income statement as it only focuses on changes in cash. In contrast, the income statement is important as it provides information about the profitability of a company. This section covers cash transactions from all of a business’ operational activities, such as receipts from sales of goods and services, wage payments to employees, payments to suppliers, interest payments, and tax payments. Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500.

Using the same comparative balance sheet information as in the previous example, note that the information to its right in item d. There are relatively few items in the investing activities section, so it is reasonable to look at them one by one to determine if there is a cash inflow or outflow and, if so, its amount. The following sample journal entries are reminders of transactions that involve cash. The Cash account is either debited or credited, to indicate a cash inflow or cash outflow, respectively.

Cash flows from investing activities always relate to long-term asset transactions and may involve increases or decreases in cash relating to these transactions. The most common of these activities involve purchase or sale of property, plant, and equipment, but other activities, such as those involving investment assets and notes receivable, also represent cash flows from investing. Changes in long-term assets for the period can be identified in the Noncurrent Assets section of the company’s comparative balance sheet, combined with any related gain or loss that is included on the income statement. The following sections discuss specifics regarding preparation of these two nonoperating sections, as well as notations about disclosure of long-term noncash investing and/or financing activities. The operating activities section of the statement of cash flows appears first.

When combined with the cash flows produced by investing and financing activities, the operating activity cash flow indicates the feasibility of continuance and advancement of company plans. In both cases, these increases in current liabilities signify cash collections that exceed net income from related activities. To reconcile net income to cash flow from operating activities, add increases in current liabilities. Gains and/or losses on the disposal of long-term assets are included in the calculation of net income, but cash obtained from disposing of long-term assets is a cash flow from an investing activity. Because the disposition gain or loss is not related to normal operations, the adjustment needed to arrive at cash flow from operating activities is a reversal of any gains or losses that are included in the net income total.

But it still needs to be reconciled, since it affects your working capital. But here’s what you need to know to get a rough idea of what this cash flow statement is doing. When you have a positive number at the bottom of your statement, you’ve got positive cash flow for the month. Keep in mind, positive cash flow isn’t always a good thing in the long term. While it gives you more liquidity now, there are negative reasons you may have that money—for instance, by taking on a large loan to bail out your failing business.