8 9 Process Costing Overview Financial and Managerial Accounting

It would be natural to assume it is about 50% complete (and thus equal to 0.5 equivalent units). In short, these are common examples where 100% of direct materials are added at the beginning of the process. Thus it would be appropriate for process costing to reflect 100% of direct material cost being incurred at the beginning of the process. Although rounding differences still may occur, this will minimize the size of rounding errors when attempting to reconcile costs to be accounted for (step 2) with costs accounted for (step 4).

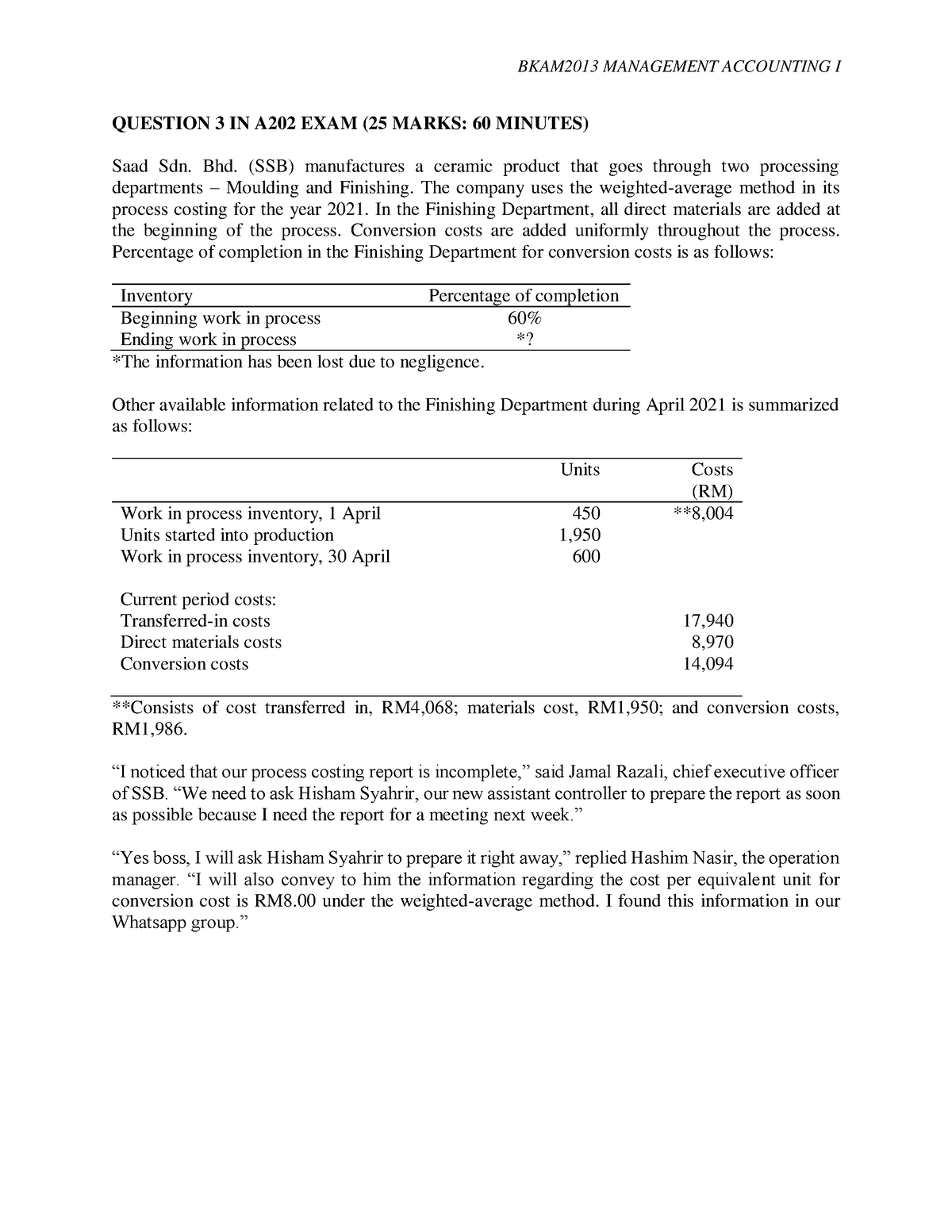

Work in Process Inventory (WIP): Definition, Formula, and Examples

- Because a large number of students in the department were part time, the full-time equivalent number of students totaled 3,240.

- Now you can determine the cost of the units transferred out and the cost of the units still in process in the shaping department.

- For some, work-in-process refers to products that move from raw materials to finished products in a short period.

- What makes this method a “weighted average” is that performance last period affects costs in future periods (it will at least affect costs this period and next period).

The WIP account is updated on a regular basis, typically at the end of each accounting period or within preset intervals like monthly, quarterly, or biannually. Or, it can be automatically kept up to date by using manufacturing software like an MRP system. Keep in mind, there are no Generally AcceptedAccounting Principles (GAAP) that mandate how we must do a processcost report.

Manufacturing costs

For example, some items that are classified as overhead, such as plant insurance, are period costs but are classified as overhead and are attached to the items produced as product costs. A piece of inventory becomes labeled as work-in-progress when raw material combines with labor. When the product is finalized, it switches from WIP to being categorized as a finished product. Finally, when the product is sold, it moves from a form of inventor to cost of goods sold (COGS) on the balance sheet. Therefore, conversion cost per equivalent unit under the FIFO method is $15.12. At the beginning of the period, each department has a debit balance for the cost of any units in beginning WIP.

2 Product Cost Flows in a Process Costing System

Although having information about the number of students enrolled (the headcount) is helpful, headcount data do not provide an indication of whether the students are full time or part time. Clearly, full-time students take more classes each term and generally use more resources than part-time students. The entity has provided the following information & wants to calculate the cost involved in each manufacturing step. For example, independent trucking company services during the month of July, Rock City Percussion purchased raw material inventory of \(\$25,000\) for the shaping department. Although each department tracks the direct material it uses in its own department, all material is held in the material storeroom. To differentiate between different financial periods, the WIP inventory value for the current period is sometimes also called the ending work-in-process inventory.

For example, suppose XYZ Roofing Company provides its residential clients’ bids for roof repair or replacement. Each roof is a different size and will require specific roofing equipment and a varying number of labor hours. An example of how to use Excel to prepare a production cost report follows. Notice that the basic data are at the top of the spreadsheet, and the rest of the report is driven by formulas.

Direct Materials

This follows the expense recognition principle because the cost of the product is expensed when revenue from the sale is recognized. While the costing systems are different from each other, management uses the information provided to make similar managerial decisions, such as setting the sales price. For example, in a job order cost system, each job is unique, which allows management to establish individual prices for individual projects. The difference between process costing and job order costing relates to how the costs are assigned to the products. In either costing system, the ability to obtain and analyze cost data is needed.

The costs are assigned/charged to individual processes or operations, averaged over the number of units produced during the said period. It is used commonly in manufacturing units like paper, steel, soaps, medicines, vegetable oils, paints, rubber, chemical, etc. use this method widely. This is why, when doing periodic inventory, it may be desirable to first finish all manufacturing orders so the ending WIP would be zero. Otherwise, the ending WIP must be calculated manually by looking up all incurred costs for the unfinished production, or by using standard costs based on the stage of the goods’ completion. Work in process (WIP), sometimes called work in progress, is a type of inventory that lies in the manufacturing pipeline between the raw materials and finished goods inventories. In other words, WIP is the part of a company’s overall inventory that has begun being processed but is not yet finished.

Recall the three components of product costs—direct materials, direct labor, and manufacturing overhead. Assigning these product costs to individual products remains an important goal for process costing, just as with job costing. However, instead of assigning product costs to individual jobs (shown on a job cost sheet), process costing assigns these costs to departments (shown on a departmental production cost report). Process costing is used most often when manufacturing a product in batches.

If two or more processes are involved in manufacturing one finished product, the question arises, “which process has consumed the expense?” The answer lies within process costing. The shaping department completed \(7,500\) units and transferred them to the testing and sorting department. No units were lost to spoilage, which consists of any units that are not fit for sale due to breakage or other imperfections.

However, a much more comprehensive solution for companies of any size lies in manufacturing software. One of the central tenets of inventory optimization is maintaining the right stock levels at all times. This can congest the shop floor, complexify routings, and introduce extra costs due to needless transportation. If WIP is too small, bottlenecks and stoppages arise, stretching lead times.

For example, it would not be cost effective for a restaurant to make each cup of iced tea separately or to track the direct material and direct labor used to make each eight-ounce glass of iced tea served to a customer. In this scenario, job order costing is a less efficient accounting method because it costs more to track the costs per eight ounces of iced tea than the cost of a batch of tea. Overall, when it is difficult or not economically feasible to track the costs of a product individually, process costing is typically the best cost system to use. In accounting, inventory that is work-in-progress is calculated in a number of different ways. Typically, to calculate the amount of partially completed products in WIP, they are calculated as the percentage of the total overhead, labor, and material costs incurred by the company. A construction company, for example, may bill a company based on various stages of the project, where it may bill when it is 25% or 50% completed, and so forth.