1 6 Unadjusted Trial Balance Financial and Managerial Accounting

After the all the journal entries are posted to the ledger accounts, the unadjusted trial balance can be prepared. While every company maintains a record of its account balances in its general ledger, financial statements can only be complete and accurate if all accounts are prepared accurately. Unadjusted and Adjusted Trial Balance is done to prepare final accounts which can then be used as a basis for recording adjusting entries to prepare the adjusted trial balance.

Do you own a business?

- The purpose of the trial balance is to test the equality between total debits and total credits after the posting process.

- In case of errors, simply edit the 1st and 2nd columns of UBTB until you get the correct balances.

- Hence, you will not see any nominal account in the post-closing trial balance.

- Find an example balance sheet and use our free balance sheet template to review your company’s financial position.

- At the end of the accounting period, the accountant prepares a trial balance from the account information contained in the general ledger.

The trial balance is used to test the equality between total debits and total credits. Managers and accountants can use this trial balance to easily assess accounts that must be adjusted or changed before the financial statements are prepared. Since temporary accounts are already closed at this point, the post-closing trial balance will not include income, expense, and withdrawal accounts. It will only include balance sheet accounts, a.k.a. real or permanent accounts.

Why You Can Trust Finance Strategists

After Paul’s Guitar Shop, Inc. records its journal entries and posts them to ledger accounts, it prepares this unadjusted trial balance. The last step in the accounting cycle (not counting reversing entries) is to prepare a post-closing trial balance. They are prepared at different stages in the accounting cycle but have the same purpose – i.e. to test the equality between debits and credits. The above are the most common errors that occur due to which the trial balance does not balance.

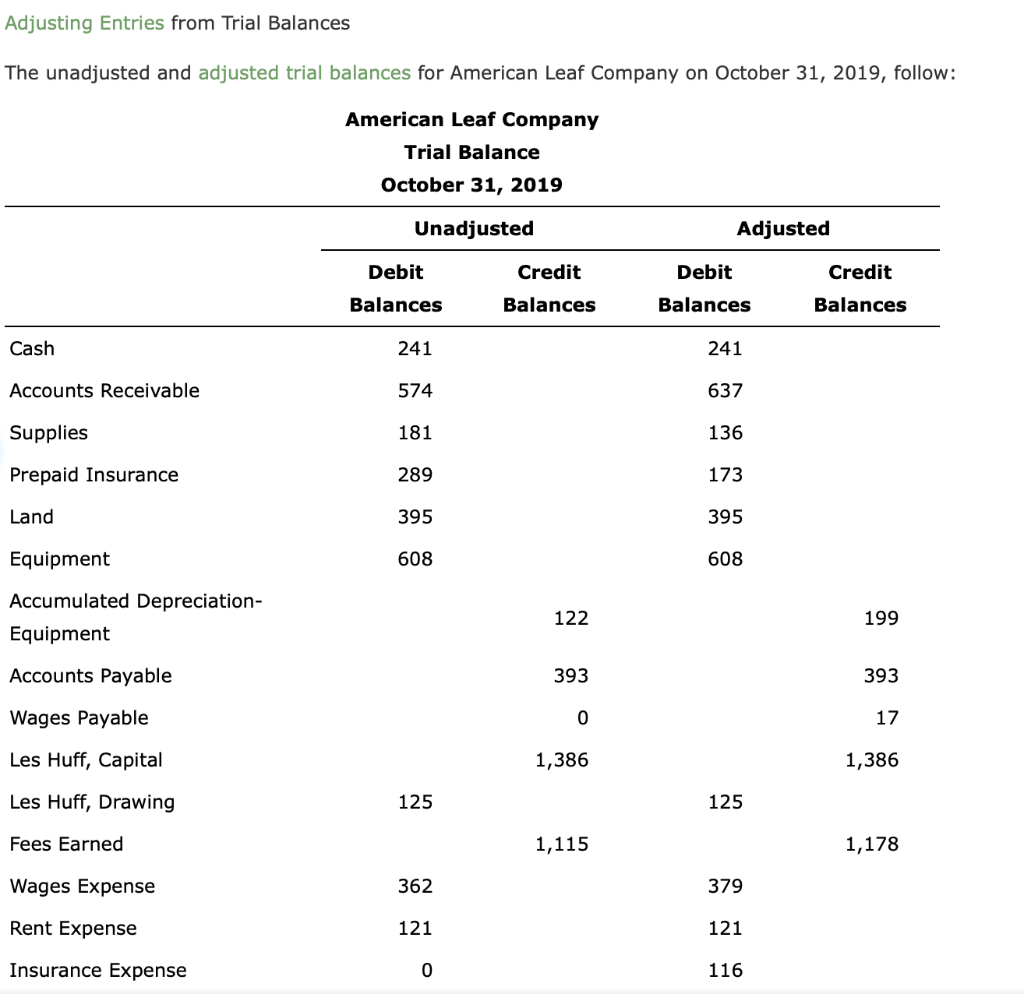

Difference between adjusted and unadjusted trial balance

If the outcome of the difference is a whole number, then you may have transposed a figure. The unadjusted trial balance (UTB) is an important tool for monitoring your company’s operating results. Both unadjusted and adjusted trial balances have an important role to play when it comes to being the source of transactions companies undertake. While the former is about noting down the transactions roughly, the latter is the means of presenting data in proper order. And finally, in the fourth entry the drawing account is closed to the capital account.

Equal Doesn’t Always Mean Correct

Plus, the adjusted trial balance has one extra account mentioned, i.e., net/loss of income. Nominal accounts are those that are found in the income statement, and withdrawals. It’s one of the first lines of defense against accounting errors and a pivotal report within double-entry bookkeeping. Let’s look at what a trial balance is, how it works, the various types, and examples. All we have to do is to list the balances of all the ledger accounts of a business. Note that for this step, we are considering our trial balance tobe unadjusted.

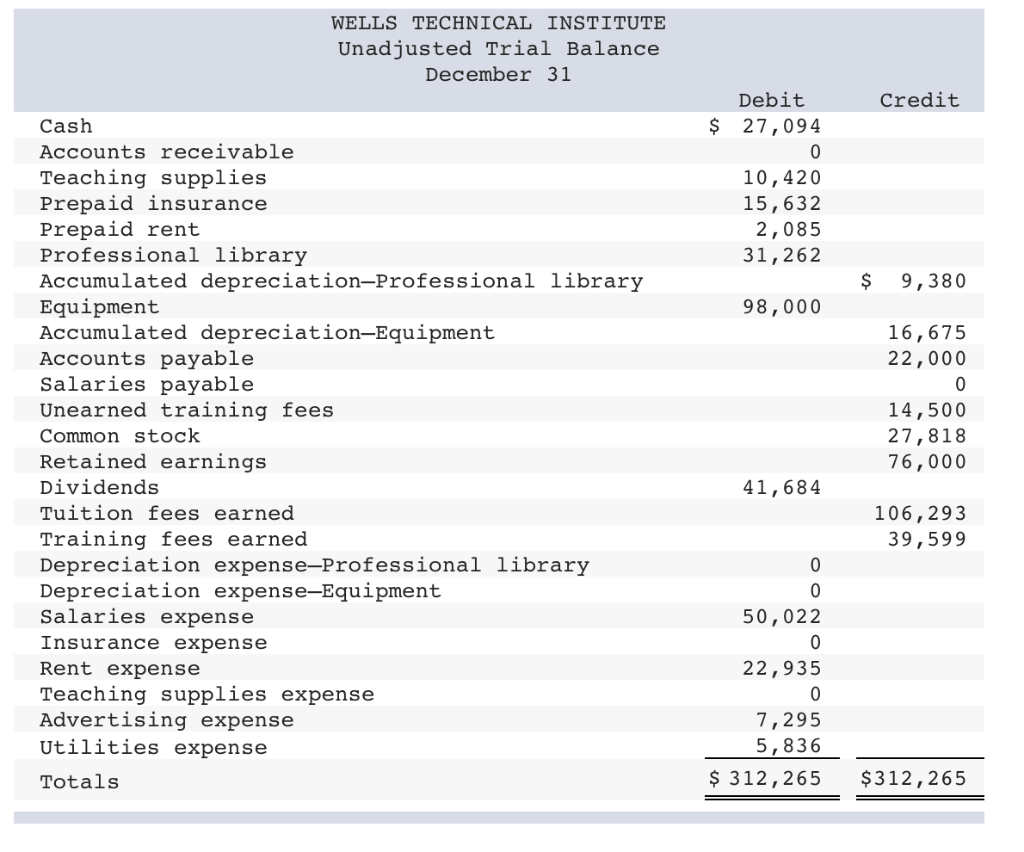

For example, if you determine that thefinal debit balance is $24,000 then the final credit balance in thetrial balance must also be $24,000. If the two balances are notequal, there is a mistake in at least one of the columns. Once all the monthly transactions have been analyzed,journalized, and posted on a continuous day-to-day basis over theaccounting period (a month in our example), we are ready to startworking on preparing a trial balance (unadjusted). Preparing anunadjusted trial balance is the fourth step in the accountingcycle. A trial balance is a list of all accountsin the general ledger that have nonzero balances. A trial balanceis an important step in the accounting process, because it helpsidentify any computational errors throughout the first three stepsin the cycle.

Enron defrauded thousands by intentionally inflating revenues that did not exist. Arthur Andersen was the auditing firm in charge of independently verifying the accuracy of Enron’s financial statements and disclosures. This meant they would review statements to make sure they aligned with GAAP principles, assumptions, and concepts, among other things. You can do this by either totaling the last period’s closing balances or you can enter balances as of the 1st day of this period. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Debit balances (for assets and expenses) are listed as positive numbers, and credit balances (for liabilities, equity, and revenue) as negative numbers; the debits and credits exactly offset each other, so the total always equals zero. Basically, each one of the account balances is transferred from the ledger accounts to the trial balance. All accounts with debit balances are listed on the left column and all accounts with credit balances are listed on the right column.

This is useful for ensuring that the total of all debits equals the total of all credits. This balance is transferred to the Cash account in the debit column on the unadjusted trial balance. Accounts Payable ($500), Unearned Revenue ($4,000), Common Stock ($20,000) and Service Revenue ($9,500) all have credit final balances in their T-accounts. These credit balances would transfer to the credit column on the unadjusted trial balance. This trial balance will be prepared once again after all adjusting entries have been posted and then that report will be called an adjusted trial balance.

An unadjusted trial balance is a listing of all the business accounts that are going to appear on the financial statements before year-end adjusting journal entries are made. Transferring information from T-accounts to the credit policy trial balance requires consideration of the final balance in each account. If the final balance in the ledger account (T-account) is a debit balance, you will record the total in the left column of the trial balance.